“Financial Intelligence & Economic Genius Webinar”

Lecturer: Prof. Wolfgang Heinrich Johannes Hein

Date: 18 & 19 August 2020

First day (18 August):

The webinar started at 10 o’clock Tehran local time with expressing an introduction by Ms. Alavash, director of Education and international affairs at AGQ Institute, about the title and educational contents of the 2-day program and the lecturer “Prof. Wolfgang Heinrich Johannes Hein”.

At the beginning of his speech, Prof. Hein stated that the purpose of this webinar is to get acquainted with the economic issues of companies in the current crisis and in the time of Corona virus, as well as to manage the financial affairs of companies in the post-crisis period. Based on experiences of large companies such as Adidas, Reebok, or automotive companies such as Volkswagen and Benz, or energy companies that use wind turbines or renewable energy, it has been taken that by increasing their studies during the Corona crisis, they managed to offer new solutions for the corporate’s financial issues.

Prof. Hein: “in the last 10 years, Germany has decided to use integrated accounting systems such as IFRS”.

- The topics of the first day of the webinar are as follows:

- The conceptual meaning of financial intelligence

- Optimal investment

- Many features of corporate profit and loss statements

- Definition of balance sheet- What the numbers really express (in general)

- Using financial intelligence, investment management to create wealth in companies

- Performance of financial calculations and return on investment

Regarding to the income structure, Prof. Hein considered cost and revenue components over a specified period of time in companies and in a business unit (usually monthly, quarterly or annually). In the income statement, four sections are classified, which are:

– Operating income

– Cost of goods sold

– Operating expenses

– Income and non-operating expenses

In the first part of the lecture, the questions asked by the participants were answered by the professor. Then, he went on to discuss about the accounting law in Germany, which is more focused on debtors and creditors rather than investors.

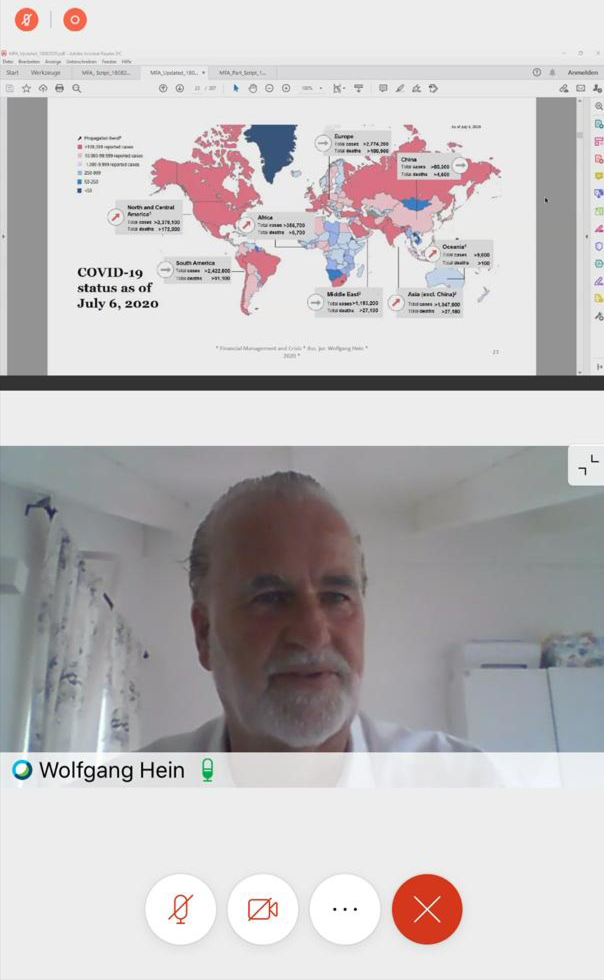

Second day (19 August):

On the second day, the discussions of financial intelligence began with the current Corona Virus crisis and the involvement of companies and enterprises with financial problems.

Prof. Hein; the performance of companies in future will be different from their past performance – corporate decisions are the right of all stakeholders, therefore the necessary information needs to be transmitted more quickly among stakeholders. In executions and accounting process, the financial teams of the companies must be selected professionally and efficiently.

The topics discussed on the second day of the webinar were taught as follows:

– Alternatives to investment flows

– Knowledge of commercial organizations in domestic and foreign investments

– Knowledge of change in existing financial systems, practical financial intelligence, circulating capital management

– Five main factors of success in the investment process

Prof. Hein: Dividing the company’s expenses into two parts, Good Cost and Bad Cost, is one of the cases in which the company’s managers and stakeholders can receive a return to the organization in a proper way, or by additional management of financial offices to avoid additional costs.

Cost control as well as the use of digital systems and digitization of the company’s financial issues can be considered an effective help in reducing costs. Entrepreneurs must be fully aware of the company’s profitability and reduction of side costs before wasting the company’s capital.

Prof. Hein mentioned some important points about economic genius, referring to some of the educational slides, which include:

– Regarding the management of the company, the financial principles and reduction of costs in times of crisis, as well as increasing liquidity and its importance in the company have been discussed.

– Simple Return on Investment (ROI), the simple return is similar to the return on total capital; however, an after-sales investment is used to calculate its return. This slide shows the calculations as an example.

In the continuation of the webinar, Prof. Hain considered the following points useful for companies

– Volume of liquidity in companies (in the short and long term)

– Financial forecasts

– Financial management in unpredictable crises

– The impact of financial control on the supply chain of companies

– Use of integrated financial software systems

Time was devoted to questions and answers.

At the end of the webinar, Ms. Alavash stated that:

Financial IQ or financial intelligence is a person’s ability to solve financial problems for themselves or others, which is defined differently for each person.

Providing an educational environment by the experienced lecturers and professors can be the beginning of people entry into the great world of financial management and also increasing the speed of their financial growth. At this institute, we try to provide our clients with management training in various fields by inviting experienced professors who, in addition to teaching, also have brilliant management records in large European companies.